I haven’t taught for a few years now since I decided to go to grad school full time. But one of my favorite things to teach occurred during the time we explored exponential growth & decay in my Algebra II classes.

I liked to teach them something that goes a little bit farther than what I consider to be weak real-world exercises located at the end of the problem sets. Although questions like investing $200 into an account that earns 5% interest compounded annually are nice mathematically, that single instance is not a practice that occurs only once in a person’s life. In fact, most people will have to save money throughout their working careers, so they will have many of these “one time” investments. What I feel is left unexplored in many math classes is how these investments and the duration of these investments impact one’s total investment portfolio.

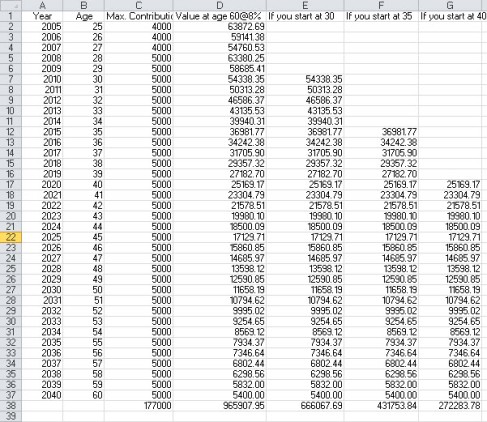

So I decided to look at contributing to a Roth IRA that made 8% compounded annually with the maximum contribution made each year. We actually used my age as a basis (I was 25 the first time I did this project) and we stopped making contributions at the age of 60, which I assumed to be my retirement age. (I believe 62.5 years old is when you can start withdrawing money from a Roth IRA without penalty, but don’t quote me on that). Then we also began other Roth IRA accounts if I hypothetically began at the ages of 30, 35, and 40 and looked at how waiting to invest has an impact on total portfolio value when I reach 60 years of age. When I began teaching in 2004 in Indiana, the maximum contribution to a Roth IRA was $4,000. A few years later (2008), the maximum contribution was increased to $5000. So my contributions for the first few years were different than the other years, but it really didn’t impact the generalizations we were able to make later on.

So my students were wondering how rich I would hypothetically be if I invested the maximum contribution from year-to-year. So my students decided that they had to treat each year as one of the problems at the end of the section. They just had a different amount of years between the contribution and the age of 60. So they still got to work on exponential growth at the level the curriculum intended, but also got a much larger picture of what happens when one combines multiple investments.

What they found out after they decided to put all this information into a spreadsheet is that I would have invested $177,000 of my own money and would have just shy of $1 MILLION by the time I was 60. But the best part was what they saw next.

If I waited until I was 30 to begin investing, I was not getting the five amounts that were listed from when I was the ages of 25 to 29. The roughly $60,000 I was earning those years (remember there was a max contribution shift) was not included, so I was losing out on roughly $300,000 if I waited five years. They noticed that the amount that I had if I began at the age of 30 was around $666,000. So from being just shy of $1,000,000 if I started when I was 25, they proposed that if I waited five years, I would have roughly 2/3rds of what I could have had if I started five years earlier.

Looking at the chart that begins at the age of 35, they made the same generalization of 2/3rds from that of if I started at the age of 30. They also compared it to beginning at 25, which they said the 2/3rds rule would be applied twice, or (2/3)^2 = 4/9. So waiting 10 years after 25, I would have a bit less than half of what I could have had. And waiting until I was 40 to begin (gulp) was roughly (2/3)^3 = 8/27, or about 30%.

I thought the 2/3rds generalization was the best, because I didn’t go into this lesson with that in mind. It was a generalization that my students came up with. And because it was their generalization, it was really eye opening for them to think about their own financial future. They realized that they didn’t have to be rich in order to end up with a lot (relative) of money.

This lesson covers a real-world problem that involves exponential growth (each year total). Looking at the combination of contributions over a working lifetime was an added bonus, something that many math courses or finance courses do not teach. In all honesty, I believe that this is some of the most important mathematics that students should learn during their high school careers, but stressing that importance is often not done in this manner.

We also explored other exponential situations like values of vehicles as they age, house values in this manner. But by far, the Roth IRA investigation is my favorite.

Kevin Lawrence

@kalawrence9